While some people can find a home they like and negotiate a fair price, many can find it difficult to get past the mortgage stage. This can be for various reasons, but today’s most significant challenges include home buyers being unaware of their options, increases in house prices, and employment issues.

Fortunately, if you know what you’re looking for, the process needn’t be as complicated as it first appears. We’ll share our top five home loan tips that will make your life easier and hopefully result in the best deal for your circumstances.

Why Is It So Difficult For So Many People To Buy New Homes?

Buying a new home is a challenge these days for several reasons, but job loss is one of the most significant. Moreover, many new entrants to the job market find it challenging to land well-paying employment that can cover their initial mortgage deposits and monthly payments.

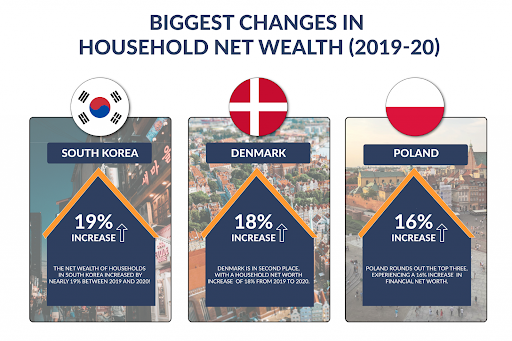

In addition to higher interest rates and job issues, house prices have skyrocketed. This is especially true in Nordic countries; as you can see in the image above by Compare the Market home loans, Denmark in particular has seen an increase in household net worth of 18% from 2019 to 2020. This increase could come from the uptick in house prices rather than from an increase in salaries.

Further to this point, studies show that almost all Nordic countries saw significant effects on their labor markets from pandemic-related lockdowns. The only anomaly was Sweden, which declined to implement strict lockdowns like its neighbors. However, even Sweden didn’t avoid labor issues altogether, as the study found that their labor issues were only delayed by two to three weeks.

In the same study, Nordic households cut back on spending because of said labor problems. From this, it’s reasonable to assume that the Housing Market was the primary reason for increasing household net worths. So what does all of this have to do with home loans? As previously mentioned, higher house prices have nudged many potential home buyers out of the market. However, there are some things you can do to make getting a loan easier.

Improve Your Credit Rating

You can probably skip over this point if you already have a stellar credit rating. However, if you don’t, you should be doing everything you can to improve it. This means paying off loans, paying off card bills in full and on time, and monitoring your report for any issues that might have an impact.

Put Down A Higher Deposit By Saving

The more you can put down as a deposit, the more likely you will get a better loan. This can be because it shows that you can afford the loan repayments. If you don’t have enough initially, you should begin an aggressive saving plan to build it up to the required deposit amount.

Shop Around And Compare Quotes

This tip is the easiest and quickest way to save money. The best way to go about it is to use a comparison website to provide you with multiple quotes from the data you enter and choose the lender that could give you the best deal.

Get All Financial Documents In Order

If you can get all of your financial data in order before applying, you can make the process far smoother. Many financial documents are required to be submitted with a mortgage application. The loan application will be processed faster if these documents are already assembled. In general, you should be prepared to submit the following:

- Two years of pay stubs

- Most recent W-2

- Last two years of tax returns

- Current bank and brokerage statements.

Prove That You Have A Stable Job

Arguably, the most crucial aspect of making your loan application more likely to succeed is to prove that you have a steady, well-paying job. You are more likely to get a loan suited to your needs if you can prove that you can make the payments.

Hopefully, this post will give you the information you need to get a good deal on your home loan. You should also work with a mortgage broker or use a comparison site to find a loan that suits your needs and financial situation.

I like how you said that shopping around to compare the quotes of different home loan services is the easiest way for you to save money. My younger brother and his wife want to mortgage their home and they need to find the right loan service. I will suggest that they compare different deals from several loan providers so they can find the best one for their needs.

“Improve Your Credit Rating” is an impressive point as discussed above in detail! Just a quick note to tell you that I have a passion for the topic “Loan tips” at hand. I am going to share the post on my social media pages to see my friends and followers. Thanks and keep up the good work!

What a wonderful post, you have put quite a lot of effort into this one, I can tell. Love everything about this, great post. Hope to see more such posts from you soon.

Its helpful when you said that the more money you can put down as a deposit, the greater your chances of getting a better loan. I want to get some home loans since me and my wife are planning to buy a new house next year. Thanks for the tips on home loans and I hope that we can get some as soon as possible.