A group of traders loves to hold on to their trades. They are known as the position traders. They do not get affected because of the short-term fluctuations as they generally focus on the bigger picture of the market and believe that the market will come to the flow itself. These investors focus on the long-term performance of the financial instruments and wait for the emergence of a trend without rushing for quick profits in price fluctuations.

Position trading and traders

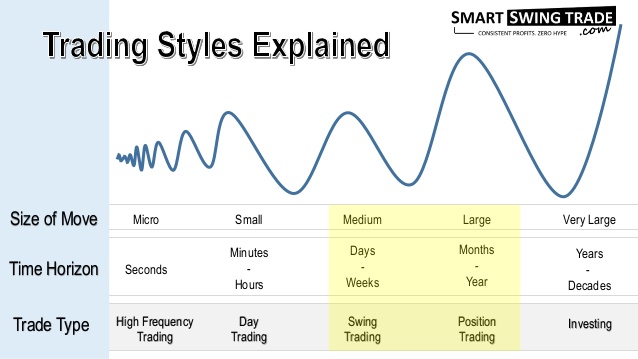

Position traders are mainly followers of the trends. They try to identify the direction and invest according to it so that they can get the best profit by buying or holding a financial instrument for a certain period, which is greater than the timeframe of day trading but less than a year. This type of investor tries to identify the right time for entry and exit price to be successful in advance and always tries to control the risk by setting up a stop-loss order. They hold the position of a financial instrument for an extended period based on the asset value, which will appreciate with time.

In this type of trade, the position of an asset can be held for a long time, and this duration may range from several weeks to a few years based on the goals of individual investors. It is considered as safe approach than the others because it emphasizes the performance of an asset-based on long-term timing.

Understanding the position trading

This study is totally opposite to day trading and quite dissimilar to swing trading, and the investors rely on the fundamental and technical analysis based on macroeconomic and the performance of the previous actions to determine the general trend off the market.

People who are involved in ETF trading needs to learn a lot about this market. Unless you do this in a systematic manner, it will be a tough task to manage the risk profile. Learn the ins and outs of this business so that you can act smart.

Working processes

They set a stop-loss order after buying a financial instrument. Try not take this type of actions as a full-time occupation. This includes technical analysis based on different instruments charts and tools to analyze the potential signals, especially during a trend reversal. Investors try to find out the trend indicators to establish potential asset investment in the future.

This type of style ignores small pricing movements that happen on a regular basis, and experts fix their eyes on the development of the trend. The primary concern is to stay in the market at a certain time until the price moves. This type of method is less stressful than scalping and traders do not need to look at the graph with full focus and work as immune to market fluctuations.

The risk to reward ratio

Before buying a financial instrument risk to reward ratio is estimated to reduce unnecessary loss and increase the amount of profit. Small price changes are ignored, but this change can lead to a reversal of the trend later. This type of investor are also popular as infrequent traders are not eager to take a larger risk based on their investment.

Before jumping towards position trading, one should identify if this type of strategy is right for him or not. No matter what style a beginner follows, but if he is not diligent enough to execute his startup, then it will be tough to be consistent. One benefit that every trader in Hong Kong gets from the position trading is to adapt to the change so that they can avoid the overnight risk. If we consider the opinions of the experts, then we will find that they prefer position trading as the competition is so much less fierce here than other trading options.